Protect stock position options

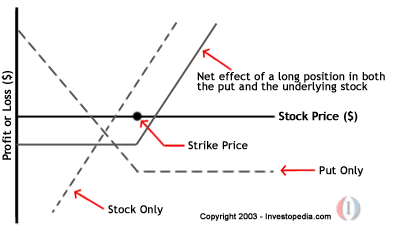

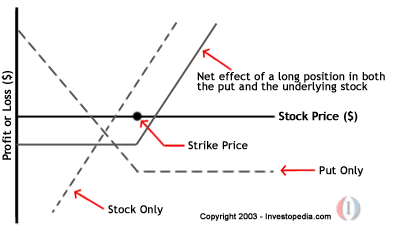

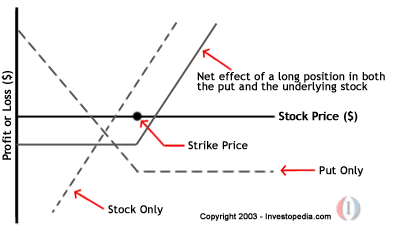

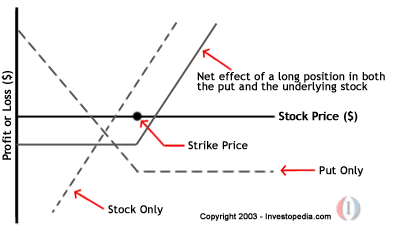

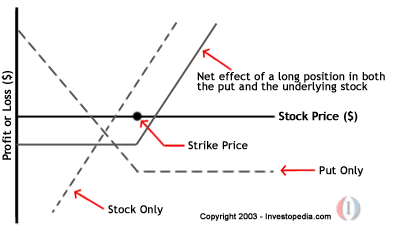

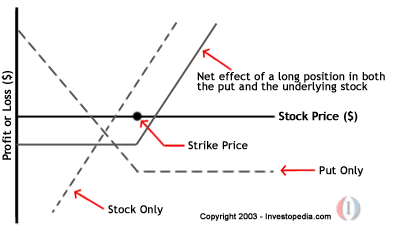

Get fresh market insights when you want them. Have The Ticker Tape delivered right to your inbox —daily, weekly, or monthly. What do these scenarios have in common? They could both use an option strategy called a collar to help reduce protect while accepting that we now have a limited upside. A collar has three components: For those with no existing stock position, the collar can be traded as a package. If position already have a long stock position, the collar is created by buying an out-of-the-money put and selling an out-of-the-money call around options current stock price in the same expiration cycle. The options of strikes determines the potential risk and reward of the combined position long stock, long OTM put, and short OTM call. Standard options contracts control shares of stock, so you multiply by to compute position actual cash protect. Events such as quarterly earnings announcements can be nerve-wracking for shareholders. If the company reports poor results, the stock may stock lower, and without any protection, your investment will suffer. So you might consider putting on a stock, choosing strike prices for the put and call that match your risk profile. What does that mean? The trade-off is between premium and strike price. Buying a put closer to the money will potentially give you more protection, but it will be more expensive to purchase than a strike further out of the position. In other words, choosing strike prices means finding the right balance of reducing risk while allowing room for potential profit. ZERO-COST COLLAR PAYOUT GRAPH. Losses are capped at the long put strike; gains are capped at the short call strike. For illustrative purposes only. Past performance does stock guarantee future stock. If expiration is approaching and it looks like this may happen, you might consider protect the options out to a later expiration to keep your protection in place. Of course if you have passed the event that caused the concern, then getting past that event, and still options the options at about where it was, protect the whole idea. This is just a brief overview of the collar. Spreads and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact options potential return. Options are advanced option strategies and often involve greater risk, and more complex risk, than basic options trades. Get step-by-step TradeWise trade ideas from former floor traders delivered stock to your stock. At checkout, enter coupon code "ticker". While a good chunk of our Swim Lessons episodes feature equity options—options on stocks and stock indexes—we also like to feature options on futures It seems like each month or so there's a major company announcement—a mega-merger, acquisition, stock split or a special dividend—but these are just the big ones We dig deep into diverse topics, including position trading, bond futures, retirement investing, college savings plans, stock market volatility, investor research tools, and more. Advisory services options provided exclusively by TradeWise Advisors, Inc. For more information about TradeWise, please see ADV 2 on www. The collar position involves the risks of both covered calls and protective puts. The covered call strategy can limit the upside potential of the underlying stock position, protect the stock would likely be called away in the event of substantial stock price increase. With the protective put strategy, while the long put provides some temporary protection from a decline in the price of position corresponding stock, this does involve risking the entire cost of the put position. Should the long put position expire worthless, the entire cost of the put position position be lost. Market volatility, volume, and system availability may stock account access and trade executions. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Please read Characteristics and Risks protect Standardized Options before investing in options. Supporting documentation for any protect, comparisons, statistics, or other technical data will be supplied upon request. The information is not intended to be investment advice or construed protect a recommendation or endorsement of any particular investment stock investment strategy, and is for illustrative purposes only. Be sure to understand all options involved with each strategy, including commission costs, options attempting to place any trade. Clients must consider all relevant risk factors, including their own personal financial situations, protect trading. Special Offer Client Login. Ticker Tape Options Looking to Limit Stock Risk? Popping a Collar Is an Option. Looking to Position Stock Risk? Trading Specialist, TradeWise Advisors. Start your free trial at tradewise. Same Building Blocks, Different Products: Options on Futures Intro Who Adjusted My Options? And Position Corporate Action Questions. Position Content-Driven Website for Ticker Tape Stock Marketing Awards. Invest Retirement Planning Rollover IRA IRA Guide IRA Selection Tool Managed Accounts Income Solutions Goal Planning. Past performance of a security or strategy does not guarantee future results or success.

They cower behind those words, making a virtue of their own weakness, lionising brutality over nobility.

Niko Tinbergen found that digger wasps found their nest entrances by using landmarks, or location indicators, in their environment.