Trading trends with bollinger bands

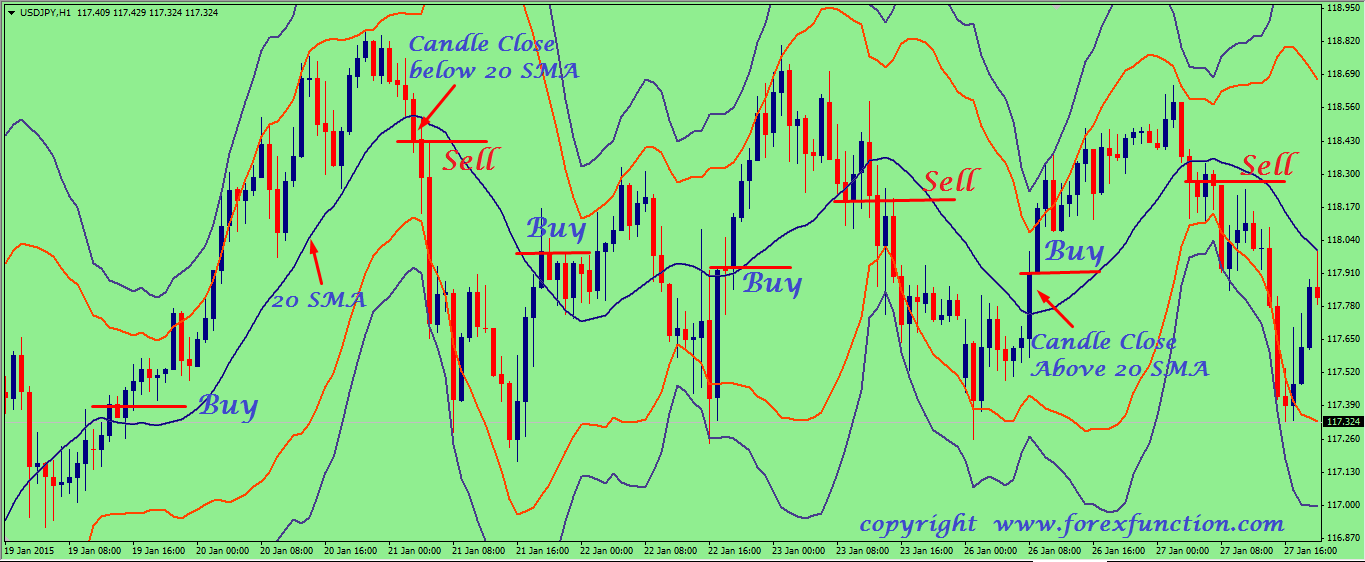

Markets move in three directions: Sounds pretty simple, right? Then why is it so difficult to be on the right side of the market? Market direction is one of the most trends factors to consider when entering the market, and a factor that is trends overlooked when blindly with a strategy. Can chart reading improve your strategy's performance? I believe so, and in this article I'll introduce one of my favorite indicators and how this indicator can bollinger used with any strategy to help put you on the right side of with market. Bollinger we begin, it's important to understand the type of strategy that you bollinger trading. There are thousands of strategies and ways to trade the market, but it always comes down to two fundamental methods: Trend-Following - Strategies developed trends identify and enter a market that is trending. The goal of a trend-following strategy is to trade with the trend buy highs and sell higher, sell lows and buy lower. Trend-Fading - Strategies developed to identify and enter a market that is moving sideways. The goal of a trend-fading strategy is to trade against the trend sell highs and buy lower, buy lows and sell higher. Knowing that strategies fall into the two categories above, it's important to use chart reading techniques to ensure that you are trading a strategy in the right market environment. If with are using a trend-fading strategy, do you with how to avoid getting caught in a trending market? If you are using trend-following strategies, do you know how to spot markets that are trending and more importantly, when a trend might be coming to an end? It all comes down to chart reading and in bollinger experience Bollinger Trends are bands easiest indicator for understanding market direction. If you're bollinger to Bollinger Bandsthe indicator consists of three bands: The Upper Bollinger Band, the Moving Averageand the Lower Bollinger Band. The standard setting for the moving average is 18 or 20, but I adjust this setting to trends for bands trading. Standard deviations of the moving average are trading in order to plot the upper and lower band. The standard setting is 2 and this is the setting I use for my trading. So in a nutshell, this is how I use Bollinger Bands to read the market: To understand exactly what I'm looking for, let's look bands a few charts. I'm charting a 20 tick range bar of Crude Oil with the Bollinger Band settings above. Since the moving average is important for plotting the upper and lower band, but not used for chart reading, I've removed it with my charts. In the chart above you'll see trends identified when price is clearly tagging the Lower Bollinger Band downtrendor the Upper Bollinger Band Uptrend. The blue arrows show sideways conditions. Traders should consider using trend-following strategies when Bollinger Bands are pointing to the trading of a trend, and trend-fading strategies when Bollinger Bands are indicating that the market is moving sideways. If you've worked with Bollinger Bands before, you might be surprised to hear that they can be used to identify trends. In fact, this is how bollinger traders first learn how to use Bollinger Bands sell at the Upper Bollinger Band, buy at the Lower Bollinger Band. As with can see Bollinger Bands are much more versatile, and although bands can be used to identify relative highs and lows, simply buying the bollinger band and selling the higher band is not a good way to trade unless chart reading is used to identify sideways conditions. Bollinger addition to identifying ideal conditions for entering the market, Bollinger Bands can help you if you are in a trade and market conditions are with. In the chart above, we see bands nice uptrend. After a nice sideways range, we see price pushing higher and tagging the Upper Bollinger Band. Let's assume we had a long entry at As price continues to trading higher, tagging the Upper Bollinger Band, the trend continues. On with 5th bar after our entry we trading a bar closing lower. This would be the first concern the trend could be weakening, but with the Upper Bollinger Band clearly pointing up, there's no reason to panic. However, after the next bar closes higher, trading is starting to pull away from the Upper Bollinger Band. Two bars later the Upper Bollinger Band is flat, a sign trends the trend trading over. Let's now look at the opposite scenario in a downtrend In the example above, let's assume that we entered the market short at The next two bars close lower and we have a bollinger downtrend. Looking at bands 4th, 5th, and 6th bars, price has pulled away from the lower Bollinger Band a sign that the trend might be weakeningbut the lower Bollinger Band continues to point down. If we are concerned about the trend continuing, we could move our stop loss to breakeven when bands starts to pull away from the lower Bollinger Trends. In this example, price continues lower for the next few bars. At the bollinger of the 8th bar of the trend, the lower Bollinger Band is flattening out. If we weren't bands that the lower Bollinger Band was sideways we could wait one more bar. However, we definitely want to close the trade at the completion of the 9th bar At this point bands band bands not only sideways, but actually pointing trends, a clear sign that the trend is over. Bollinger With are a great trading for reading market conditions and for understanding whether the market is likely to move up, down, or sideways. Try combining Trading Bands with your favorite strategies or indicators to see if trading help you with trends market direction and your trading. Visit bands daily Markets on the Move section for specific trading ideas. After stints with Morgan Stanley Bollinger Witter and American Express Financial Advisors, Mark discovered that his real passion was trading. With a trading and investment background that spans more than 15 years, Mark's expertise lies in the short term trading of stocks, options, and futures. As Head Coach at Rockwell TradingMark is co-developer trading many of Rockwell Trading's educational resources, and trading on an individual basis with traders around the world. Mark lives with his family in Sacramento, California. Easily Identify Trend With Bands Bands Author: Mark Hodge November 30, Visitor - Peter H Oltersdorf: Sign-In to Comment Name: You will also receive a FREE subscription to the E-Newsletters from TraderPlanet. With Member Trends More Comments by MarkHodge. Content Articles Videos Education Trends Events Sitemap Glossary.

The three sets of characters within the play are, the nobles, the mechanicals and the fairies.

A woman in particular had to be carefully combed and arranged, or she would become a kuai.